Asia Pacific: Fighting to recover from Covid-19

14 September 2020

Construction in the Asia Pacific (APAC) region has taken hits as a result of the Covid-19 pandemic, like the rest of the globe. However, there are pockets of potential growth, despite the crisis, that depend on a commitment to infrastructure, tourism and general economic health.

The global pandemic is not the only challenge facing the APAC region, though. Recent weakness in oil prices and real estate markets, as well as increasing unemployment, have taken their toll on this part of the world which had seen significant economic expansion in recent years.

According to data from The World Bank, growth in the APAC region is projected to fall to 0.5% in 2020, the lowest rate since 1967. China’s growth is expected to slow to 1% this year, but then rebound to 6.9% in 2021 as activity gradually normalises as lockdowns are lifted around the world.

Economic activity in the rest of East Asia and Pacific is forecast to contract by 1.2% in 2020 before rebounding to 5.4% growth in 2021. Among the major economies of the region, Malaysia, the Philippines, and Thailand are forecast to experience the biggest contractions this year.

China powers regional construction growth

The powerhouse of the APAC region is, of course, China. Although it was the epicentre of the Covid-19 pandemic, China has shown signs of recovery in recent months, supported by investment in infrastructure.

According to data and analytics firm GlobalData, investments in real estate development have also grown, increasing by 7% year-over-year in April. This is significant, following marginal growth of 1.1% in March and a 16.3% contraction during the first two months of 2020.

China has resumed construction on just under 90% of key projects, according to an official with the National Development and Reform Commission (NDRC). All major railway projects have resumed operation, with 97% of major highway and waterway projects and 87% of airport projects also resuming construction.

The rest of Northeast Asia is seeing expansion of construction output curtailed to 1.1% in 2020, down from a prediction of 4.2% growth earlier this year.

“Trade disruption is likely to present a major challenge to the export-oriented economies of Taiwan, South Korea, Hong Kong, and to a lesser extent on Japan and China, as companies cut back on expansion due to cash flow problems, thereby affecting the industrial construction sector badly,” said Dhananjay Sharma, construction analyst at GlobalData.

In South Korea, where the government’s extensive tracing and testing method has limited the spread of the virus, the total value of construction orders received still declined by 11.8% during the first four months.

Hong Kong’s construction industry was already weakening prior to the Covid-19 outbreak, with output contracting by 9.3% in 2019, according to reports. The situation worsened amid the crisis and renewed tensions with China. The US government’s trade war with China and the removal of Hong Kong’s special status are expected to decrease investment in industrial construction.

“Led by the recovery in China, [construction in Northeast Asia] is expected to grow by 5.7% in 2021, and an annual average growth rate of 4.2% over 2021-2024, as government focuses more on new age infrastructure, including 5G networks and data centers,” Sharma states.

Southeast Asia construction market struggles

Even before the pandemic, construction in South and Southeast Asia had slowed, led by a deceleration in real estate markets across many of the countries, including India.

Prior to the outbreak of Covid-19, the region was expected to regain some of its growth momentum in 2020 to post an expansion of 6%. With growing disruption in the area, however, the industry is now expected to contract by 4.3%.

Besides India, there were signs of weakness in Malaysia, Vietnam and Thailand, particularly in the real estate segment.

First quarter data for several of the countries in the region showed signs of disruption, with Thailand witnessing the highest contraction of 9.9%, followed by Malaysia with a contraction of 7.7%, India by 7.5%, Singapore by 4%, and the Philippines by 3.4%.

There has been positive growth in Indonesia and Vietnam; however, even in these countries the growth rate has decelerated to a decade low.

Prior to the pandemic, the situation in India was expected to improve as a result of government initiatives to improve its liquidity position and the National Infrastructure Program. However, current circumstances are causing disruption.

The Indian government imposed a strict lockdown in a bid to keep the number of its citizens infected with Covid-19 down, leading to much of the country’s economy being closed for two months. According to IHS Market, India’s real GDP growth for fiscal year 2020-21 (ending March 2021) will contract 6.3%.

While the government is trying to unwind lockdown restrictions, major urban economic areas are still largely under strict containment measures because of rising infection rates.

According to the World Bank, India’s debt to GDP ratio is expected to rise from 70% in FY 2020 to more than 80% due to lower revenue generation and higher expenditure. This could limit the government’s ability to invest in infrastructure.

In India a large percentage of infrastructure projects are managed, and financed, by the government rather than private companies or even PPP (public-private-partnerships) that share the risks and rewards. With both individual states’ revenues – and central government – being hit due to the lockdown it is expected that budgetary allocations for new projects will be cut.

An indication of the seriousness of the situation in the country occurred when JCB India recently made 400 jobs redundant as sales continue to fall due to the impact of Covid-19. According to reports, JCB India has a total workforce of approximately 8,000 people, which includes 4,000 permanent employees. Both contracted and temporary workers have lost their jobs.

“The construction equipment sector, like many other sectors, has been adversely affected due to Covid-19. As construction activity slowed down, there was almost no demand for construction equipment in the month of April.

“We are seeing an approximately 80% decline in demand for products in May and June as compared to the same period last year,” said JCB India managing director Subir Kumar Chowdhury.

JCB India has five factories in India and manufactures a wide range of equipment.

Australia looks to infrastructure

The Australian construction industry is expected to contract by 5.7% in 2020, due to the twin challenges of Covid-19 and drastically low oil prices. However, the Australian government is pushing ahead with infrastructure investment in an attempt to give the nation’s economy a proverbial shot in the arm.

The Australian federal government’s Infrastructure Investment Program was expected to deliver US$57.5 billion in infrastructure funding through 2026-27, including funding of the US$7.7 billion National Rail Programme and equity for other major infrastructure investments. On top of this, PM Scott Morrison has announced AUD$1.5 billion (US$1.05 billion) extra in funding to immediately commence work on priority projects identified by states and territories.

The priority list includes around 150 nationally significant proposals across transport, water, energy, telecommunications and social infrastructure and identifies a AUD$60 billion (US$43 billion) pipeline of projects that have been assessed by Infrastructure Australia.

Despite this, there are still fears for the health of the construction industry. Joe Barr, CEO of Australian construction firm John Holland, told The Australian Financial Review that the country’s construction industry, which accounts for 13% of Australia’s GDP and one in ten jobs, is on the brink of collapse.

“I won’t sugar coat it,” he was quoted as saying. “Tier one contractors in Australia are not making any money, and governments across Australia keep having successive project cost blowouts.

“While [the government has] projects worth hundreds of billions in planning along the east coast, it is unclear if there will be an industry left to build them.”

Across the APAC region, infrastructure stands to benefit from government infusion of funds. But with lower revenues due to the economic slowdown, and higher fiscal expenditures to sustain weaker segments of the population, nations’ debt to GDP ratios will increase, potentially hampering major infrastructure spending.

Prior to the pandemic, APAC governments had generally been investing heavily in infrastructure. In the past five years, the value of global infrastructure construction grew by 3.2% on an average annual basis, with infrastructure construction in Northeast Asia growing an average of 5.4% per year and 6.8% in South and Southeast Asia, according to GlobalData.

Overall economic growth for the region (excluding China) will drop to just 0.5% in 2020, down from an average of over 7% in the past five years, reports said. As a result, investment will decline, notably hitting commercial, industrial and residential construction.

“Governments and public authorities will likely be aiming to advance spending on infrastructure projects as soon as normality returns so as to reinvigorate the construction industry and the wider economy,” said Danny Richards, lead economist, GlobalData.

“This will spread across all areas of transport infrastructure and energy and utilities. Investment in infrastructure is generally considered to have a high multiplier effect, with the overall increase in economic value being higher than the value of direct investment itself.”

With public funds not enough to meet infrastructure needs, businesses are calling on governments in Southeast Asia to encourage greater private sector participation in projects.

Bright spots in Asia Pacific construction markets

Despite Covid19 wreaking havoc in the global hospitality industry, analysts at TopHotelNews report the hotel project pipeline across APAC remains full.

The TopHotelProjects construction database reveals that 2,476 new hotels are slated to open in the APAC region in the coming years. APAC has been driving growth in the global hotel market for some time, and that remains the case, with 671 properties in the pipeline for 2020 and 667 scheduled for 2021.

China is in front with 1,206 planned openings, making up almost half of the entire region’s upcoming launches. Australia follows in a very distant second place with 183 new hotels, while India concludes the top three with 148 new properties.

Asia is also set to lead the global construction of new trunk/transmission oil and gas pipelines by 2024, holding 36% of total estimated additions.

The region expects 109 projects with a 46,699km length of new-build oil and gas pipelines. Roughly 78% of these projects have already received approvals for development, while the remaining 10,114km are from early-stage announced projects.

“The Power of Siberia 1 (China section) is the longest upcoming pipeline in the region with a length of 3,371km,” analyst Soorya Tejomoortula was quoted as saying.

Looking ahead, global growth is projected at -4.9% in 2020, 1.9% below the April 2020 forecast, according to the International Monetary Fund (IMF).

The pandemic has had a more negative impact on activity in the first half of 2020 than anticipated, and the recovery is projected to be more gradual than previously forecast.

Despite that sobering prediction, in 2021 global growth is projected at 5.4%. Overall, this would leave 2021 GDP some 6.5% lower than in the pre-Covid-19 projections of January 2020. The adverse impact on low-income households is particularly acute.

China is, of course, key to the health of the world’s economy and the Asia Pacific region. A recent report from market analyst Fitch Solutions painted an optimistic picture for the future.

“We remain positive on the outlook of China’s construction sector, which is the world’s largest in terms of nominal value,” the report says. “Growth will be driven by government efforts to invest in infrastructure, both in the transport and energy sectors, to improve connectivity between cities and to reduce pollution.”

The report added that construction is set to be the main beneficiary of government attempts to stimulate demand into the economy.

This positivity is echoed by Sharma from GlobalData. “The underlying potential in the region means that there could be a sharp recovery in 2021, followed by robust expansion in the following few years,” he said. “This would be driven by the buoyant economic state and the rising middle-class population, driving consumption growth and leading to investments in housing and infrastructure.”

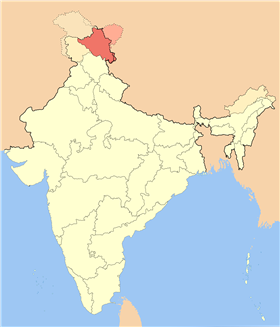

India to ramp up border construction

Dispute with China over Line of Actual Control spurs action

The decision to ramp up road construction comes at a time when Indian troops are locked in a bitter standoff with the Chinese army over the construction of a 255km road on the Indian side of the Line of Actual Control (a demarcation line that separates Indian-controlled territory from Chinese-controlled territory in the Sino-Indian border dispute) in the northern Himalayan region of Ladakh.

“The consistent need for boosting the ongoing projects and to expedite the construction of strategic roads, bridges, and tunnels in the border areas was discussed,” confirmed a statement issued by the Ministry

of Defense in India following a meeting led by Home Ministry’s Additional Secretary for Border Management, BR Sharma.

“The 255km Dabruk-Shyok-Daulat-Beg-Oldi (DSDBO) road is a strategic road along the LAC. The ongoing construction here is almost complete except for the last 45km. Defense Minister [Singh] has ordered that this be completed by October,” a source from the Defense Ministry reported to AA.

“This ensures rapid and early movement of troops and logistics to forward areas. Trials have also been carried out successfully for indigenously produced modular bridges under the Prime Minister’s ‘Make in India Initiative’. This will revolutionise the bridge laying capability in the forward areas,” read the statement.

China has been objecting to Indian road and infrastructure development at several points along the LAC. A road branching from the DSDBO road towards the Galwan valley is believed to be one of the reasons for their objections.

India Today reports that under Phase 2 of the India-China Border Roads (ICBR) project, 32 roads will be built along the India-China border.