RentalTracker: a quarter of two halves

30 April 2020

In the last ERA/IRN RentalTracker survey that was carried out – for the third quarter of 2019 – it appeared that the European rental industry was approaching 2020 with some caution. Little did rental companies know just how cautious they needed to be. Little did anyone know.

The Covid-19 crisis has developed rapidly, taking us all by surprise. At the beginning of the first quarter of 2020, there were some murmurs of concern about how it might affect supplies coming from China; by the second half of March, a number of European countries were going into lockdown, with construction sites closing.

The results of the RentalTracker present several problems. First, the survey was open from 17 March to mid-April, spanning the period when Europe’s major economies were considering, and then implementing, full lockdown.

Over those four weeks, projections for the global economy and construction were utterly changed, meaning that someone responding to the survey on 17 March was living in a different world from the person answering on 15 April.

Second, the nature of the crisis in countries like Spain, the UK, Italy and France meant that rental companies and the associations supporting them were wrestling with profound issues. This meant a significantly lower number of survey responses from these major economies, which makes it impossible to report on a country-by-country basis.

Third, the results are skewed slightly by a much higher response than usual from Russian rental companies, for which we are grateful to the Russian Rental Association.

Overall, we had more than 100 responses, although more than 25 were from Russia.

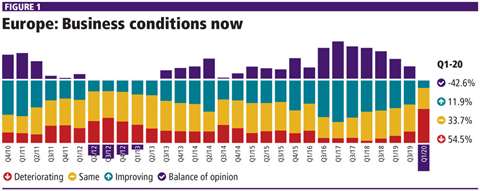

Looking at current business conditions across Europe, just over 54% of survey respondents said that business conditions were currently worsening, while just under 12% suggested they were improving. With almost 34% seeing no change in the first quarter, this gave a balance figure of -42%. It is the first time this figure for business conditions in the ERA/IRN RentalTracker has dropped into the negative since the beginning of 2013, and it is a steep fall from the positive balance figure of 20% in the previous survey.

The drop in market activity is mirrored by the lower year-on-year growth, when comparing the first quarter of 2020 with the equivalent period in 2019.

Taking Europe as a whole, 38% reported year-on-year growth, representing a significant drop from the 47% recorded in the previous RentalTracker six months ago. This continues the downward trend seen in the RentalTracker year-on-year comparison since the beginning of 2018. Also, the overall balance figure for year-on-year growth came to 5.8%, reaching its lowest point since 2013. Excluding Russian responses, that balance actually rises to 7.7%, remaining positive.

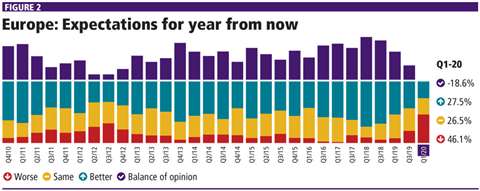

Although the future is always difficult to predict, the Covid-19 crisis has made it even more opaque. What are rental companies thinking about business conditions a year from now? The balance figure has dropped into negative territory for the first time in the RentalTracker’s history, sinking to -18.6%. That figure stays the same regardless of whether Russian companies are included or excluded.

Of all respondents across Europe, 46% predict a decline in activity in the first quarter of 2021 compared with the first quarter of this year, while 28% are expecting a positive development and 26% do not foresee any significant change.

The European rental market has never faced a crisis like the covid-19 pandemic, and inevitably the Q1 2020 ERA/IRN RentalTracker survey struggles to paint the full picture.

Nobody knows when normality will return and it is impossible to predict the long-term economic impact. However, a more stable situation may emerge over the coming months, and for this reason we aim to carry out a Q2 survey in late June. We hope that, by then, the way forward will be clearer.

A full analysis of the first-quarter 2020 RentalTracker will be featured in the June issue of IRN.