RentalTracker: lingering uncertainty

29 October 2020

As the Covid-19 pandemic rumbles on, European rental companies continue to face challenging times. However, the ERA/IRN RentalTracker survey for the third quarter of 2020 shows signs of recovery and optimism about the future.

While the balance figures for a number of the survey questions dipped into the negative for the first time in a while in the last survey, most of them have returned to the positive – though, in some cases, only just.

The ‘balance’ figure recorded for each question in the survey is the percentage of positive responses less the percentage of negative responses.

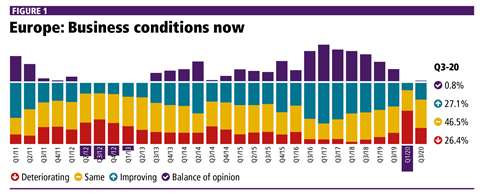

Looking at current business conditions across Europe, 27% of survey respondents said that business conditions were improving in the third quarter, while 26% suggested they were worsening, giving a balance figure of 1%. Almost 47% saw no change in business conditions in the third quarter.

Although this balance figure is low, it is certainly an improvement from the last survey in Q1 2020, when the balance figure for business conditions dipped into the negative (-42.6%) for the first time since the beginning of 2013.

One Swiss respondent made the observation that market demand has shifted towards shorter-term rentals due to uncertainty about the longer-term. They also suggested there is particularly high pressure on prices for medium and large assets.

The tough market conditions resulting from the pandemic were unsurprisingly reflected by the lower year-on-year growth, when comparing the third quarter of 2020 with the equivalent period in 2019.

Taking Europe as a whole, 24% reported year-on-year growth, representing a significant drop from the 38% recorded in the previous RentalTracker six months ago. This continues the downward trend seen in the RentalTracker year-on-year comparison since the beginning of 2018. Also, the overall balance figure for year-on-year growth came to -10.9% – the first time the balance figure has been negative since early 2010.

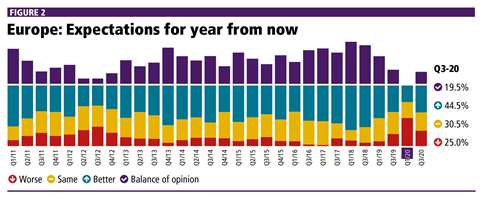

Perhaps it is an impossible question given the uncertainty caused by the Covid-19 pandemic, but what are rental companies thinking about business conditions a year from now? Well, the balance figure for what rental companies are expecting business levels to be in 12 months’ time has rebounded to 19.5%, from the -18.6% recorded in the RentalTracker survey for the first quarter of the year – which was the first time it had been negative in the survey’s history.

Of all respondents across Europe, 45% predicted that activity will be higher this time next year, which is a significant improvement on the 28% that were predicting an improvement in the last RentalTracker survey. Meanwhile, 32% said they expected lower activity in 12 months’ time, compared to the 46% that were foreseeing a reduction in the first quarter 2020 survey.

The quick, V-shaped economic recovery hoped for earlier in the pandemic has not materialised, and the great uncertainty that remains in the industry is clearly visible in the results of this RentalTracker survey.

Since uncertainty can encourage construction companies to shift away from the ownership model, it can be good for rental – at least in the longer-term. In the shorter-term though, while the pandemic lingers on, rental companies continue to adapt.