ABC reports uptick in material and input pricing for US market

13 August 2024

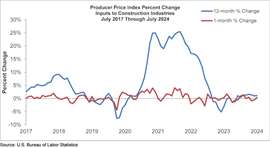

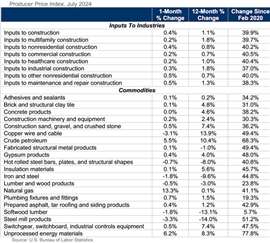

US construction material input prices increased 0.4% for both residential and non-residential building in July compared to the prior month, said the US-based Associated Builders and Contractors (ABC), a national trade organisation with more than 23,000 members from the built environment.

The increase ended a modest streak of two consecutive monthly declines for input prices, said ABC. The analysis came from data distributed by the US Bureau of Labor Statistics.

The rise was driven largely by price increases in all three energy subcategories: natural gas (up 13.3%), unprocessed energy materials (up 6.2%), and crude petroleum (up 5.5%).

Year-on-year, construction input prices are 1.1% higher in the residential segment and 0.8% in non-residential.

With all things considered – the post-pandemic economy that includes high inflation and borrowing rates amid a tumultuous general election year – ABC Chief Economist Anirban Basu was positive.

“The lack of materials price escalation over the past 12 months is a welcome development for contractors; just 34% of whom expect their profit margins to expand over the next six months,” said Basu, referring to data gleaned from ABC’s Construction Confidence Index. “Ongoing input price moderation, along with the prospect of lower interest rates by the end of the third quarter, should bolster contractor sentiment in the coming months.”

Still, he noted the industry is anxiously waiting for the US Federal Reserve to lower borrowing rates.

“Contractor confidence regarding profit margins now stands at the lowest level since November 2022, which comes as little surprise,” added Basu. “There are now strong indications that elevated interest rates have finally taken their toll on a number of privately financed construction segments as well as the broader economy.”

And while input prices dipped or remained relatively flat so far this year, they are still historically high compared to 2019.

“While inflation has moderated in recent months, construction materials prices remain almost 40% above pre-pandemic levels [as] the industry eagerly awaits lower interest rates,” said Basu, who also projected that “given recent economic turmoil, the Federal Reserve will begin cutting rates at its September meeting.”