How is inflation impacting equipment rental companies?

26 September 2022

High inflation rates present a combination of problems and opportunities for rental companies, as rental consultant Jeff Eisenberg explains.

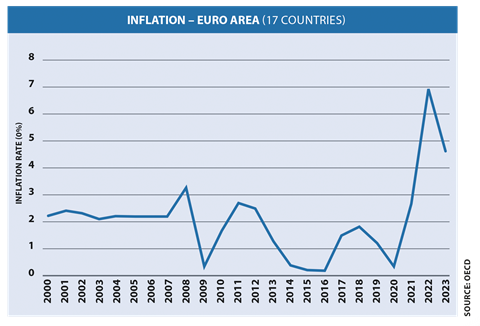

After multiple years of inflation of under 2%, many markers are now seeing double-digit rates. Mostly it has been caused by the war in Ukraine and energy prices, with multiple consequences.

Aggreko generators operating at the Open Golf tournament in St Andrews in July 2022. (Photo: IRN)

Aggreko generators operating at the Open Golf tournament in St Andrews in July 2022. (Photo: IRN)

It has added to supply chain problems originally caused by the Covid pandemic. Inflation affects different parts of the rental industry in different ways, and also presents some opportunities.

Rental rates may increase, and equipment can hold or increase its value, in a market with some moderate inflation. To maximise profitability, every aspect of rental needs to be re-thought with inflation in mind.

While rising prices of new rental equipment is important, even more important are rental rates, and other costs, including personnel.

Rental equipment rate increases

Finally, after many years of ‘stuck’ rental rates kept low by competition, customers in many markets are willing to accept rental rate increases and indeed expect them. This is not in every market and not in every category and is market and competition dependent.

The key to raising rental rates is communication with customers. This starts with communication from customers. Can customers raise the prices they charge their customers? Is this visible and quantifiable? Are customers themselves raising salaries and wages to stay competitive when recruiting and retaining staff?

Look at your customers’ own financials, where these are visible via company registries and credit reports, plus numbers reported to stock exchanges. What are they telling stock markets about their own margins? Is their revenue rising faster than their costs, compared to their investments?

This implies price increases, and higher business volumes. If the customer’s own profitability is increasing, they will be more likely to accept sustainable price increases from suppliers.

Many rental companies raise rental prices successfully throughout the economic cycle, and some hesitate. Suppose we raise our prices and the competition steals our customers?

Photo: OECD

Photo: OECD

Remember, in most markets inflation over the past three decades has been lower than for the last hundred years.

Now, with 10% plus inflation affecting many costs, especially personnel, fuel and transport, and equipment replacements and repair parts, rental rates have to stay sustainable, moving with the costs.

If they don’t, the rental company risks getting squeezed between risking costs and static revenue.

Equipment gets more difficult to replace if margins are declining and lenders are less willing to lend. This, plus high debt, can be a poisonous mixture.

Transport rates for rental equipment

Transport rates are a particular challenge, with customers quick to demand subsidised delivery or even free transport for long rentals.

Customers of rental equipment are conscious of fuel prices and expensive (and scarce!) drivers, and very often accept that transport costs will be more than last year.

And transport price increases do not have to be limited to 10%, as fuel prices have increased 60% or more since the beginning of 2021 (Europe average) according to the European Commission Oil Bulletin.

Particularly in the UK, many transport rates have increased by 50% or more, with some rental companies charging a premium for deliveries at certain times.

Raising rental rates even in a market with inflation is not as easy as it sounds. Ongoing rental contracts may be impossible to modify, especially if the equipment is on medium- or long-term use.

Some customers, particularly larger companies, will only be open to negotiate once a year. On the other extreme, where a market is not overly competitive, plenty of companies are raising rental rates twice a year or more.

Budgets and forecasts

To be complete and credible financial plans must take inflation into account. This is as true for revenue as it is for operating and personnel costs and equipment values, whether bought and sold.

The good news is that in many markets there are several sources of independent information that can support assumptions.

Inflation predictions from the OECD and others, construction company forecasts and share prices, and even some industry rental rate surveys, can all help.

Richie Bros and Rouse Services have excellent information on used equipment prices and rental metrics, although this is deepest in North America and some of Europe, and not yet available in the Middle East, Asia, Africa and others.

Beware of the ‘conservative budgeting trap’. It’s easy to take last year’s rental rates, last year’s costs, and roll the numbers forward in Excel to make a new budget or forecast.

Inflation increases used equipment values as well as that of new machines. Pictured is a Ritchie Bros auction in Florida. (Photo: Ritchie Bros)

Inflation increases used equipment values as well as that of new machines. Pictured is a Ritchie Bros auction in Florida. (Photo: Ritchie Bros)

An effective budget will have detailed predictions with third party data on rental rate changes, utilisation and seasonality, including holidays such as Easter and Ramadan.

Costs can be predicted and linked to fuel price forecasts, and data from transport and freight haulage associations and steel and equipment manufacturers can help.

How does inflation impact the price of used equipment?

Ritchie Bros, the world’s largest auctioneer, has far reaching information on used equipment values. This comes from Ritchie’s acquisition of Rouse Services as well as its auction reports.

Rouse Analytics gets a direct feed of used sales prices and rental rates from most of the largest rental companies in North America and some Europeans, hopefully expanding to other markets soon.

Two big trends can be noted in sales of used ex-fleet rental equipment. One is price increases - some specific models have auction values 15% or higher than a year ago.

These increases are usually directly linked to long delivery times and price increases for new equipment.

The other trend is decreasing volumes. It is no secret that most manufacturers have longer lead times than usual, some more than one year.

Supply chain problems, and to a lesser extent workforce constraints, are causing this. As a result, rental companies are holding onto their equipment longer: this is visible in most annual reports for those listed on stock markets.

This affects prices of used equipment and is related very closely to the reduction in supply.

Price increases on equipment above 10% makes for an interesting comparison between depreciation and inflation. Many large rental companies depreciate big equipment at 10% per year or less, so 10% inflation makes it feel ‘free’ to own equipment, certainly for the first year. But this is not the whole story.

The impact of inflation on rental fleet asset management

Big changes in equipment economics, such as inflation in used equipment values, means rental companies should review their asset management strategy.

How long should equipment be kept in the fleet before selling? Perhaps equipment that was kept five or more years and refurbished could be sold sooner, keeping average fleet ages lower?

Not every rental company keeps its fleet for five years or more. There are multiple examples of one- and two-year rollouts.

This is even more common in the vehicle rental industry, where used items are easy to move on. Each market and equipment category will have its own dynamics, but a small percentage change for Loxam’s €4 billion fleet, for example, can have a big impact on profitability.

It’s an oversimplification, of course, but 10% of €4 billion is €400 million. That compares to last year’s profit before tax for the group of €92.7 million.

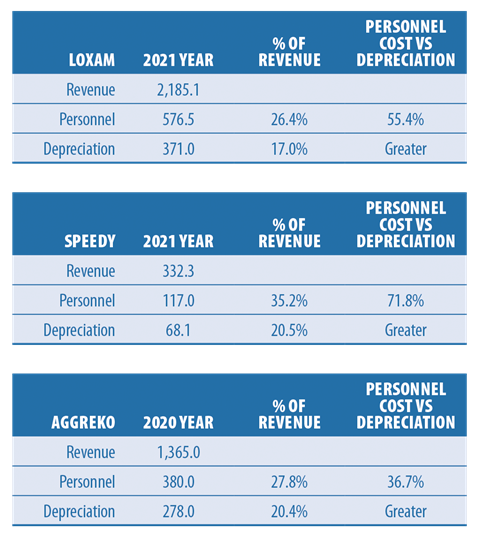

Do rental companies spend more on equipment or people?

Most rental companies have more total salary expenses than depreciation. You thought we were in the equipment business? We are in the people business first, and we also supply equipment.

Loxam is one of the world’s largest international rental companies and publishes financials, so we can see total personnel costs and compare them to depreciation.

The usual caveat applies when using abbreviated financials to make comparisons and conclusions – it’s rarely the whole story and it’s difficult to compare apples with apples.

For example, a rental company that transports equipment using its own drivers and trucks would have a different personnel expense compared to a company that buys in transport services.

Loxam in 2021 had personnel expense 55% higher than its depreciation. If its personnel expense went up by 10%, this would add nearly €58 million of costs.

Loxam’s profit before tax in 2021 was €92.7 million on revenue of €2.18 billion, so €58 million of extra cost is more than half the bottom line.

But a revenue change of 2.5% (think rental rates) would have the same effect on the bottom line, all things being equal.

If the new equipment price went up by even 20%, this would have a much smaller impact on Loxam’s bottom line. Used equipment values would increase, giving more profit on disposal.

Loxam in 2021 reported CapEx (net increase) of €402 million on original cost fleet of €4.956 billion. So, in theory, an extra 20% of this would be depreciated over ten years, which is less than €10 million per year.

In other words, a much lower impact than the 2.5% rental rate change, or the 10% personnel exchange, in the examples above.

Speedy in the UK has a smaller average equipment size than Loxam. It has an even larger difference, with personnel costs almost 72% higher than depreciation costs for 2021.

Even equipment-intensive Aggreko, the world’s largest power rental company with more than 6,000 MWs of power on hire (2020 numbers), spent 36.7% more on people than on equipment depreciation.

Unfortunately, the big US rental companies – United, Sunbelt, H&E and Herc – do not separate out total personnel expense.

The US relationship between personnel expense and depreciation would likely be similar to Loxam and the others above. In fact, reported mechanics salaries in the US are somewhat higher than most European countries.

Inflation and slow collections

Another trap to avoid in higher inflation markets is slow collections. Many markets such as the Middle East see invoice collection times in construction of six months or more.

10% inflation therefore feels like a 5% price discount. These markets often have higher interest rates, so finance costs of over 10% plus inflation at 10% make receivables very difficult to carry.

In conclusion, rental company managers may worry about equipment costs going up, and these rises are important, but the first priority should be managing rental rates and personnel costs, then transport and other overheads.

Equipment price inflation can help as much as it hurts, provided rental companies optimise their asset management, both buying and selling.

About the author

Jeff Eisenberg has been in the rental business since starting at Genie in the 1990s financing rental company expansions. He has since advised, started, run, acquired and sold rental companies on multiple continents.

Jeff Eisenberg

Jeff Eisenberg

Currently he is a non-executive director at UK based Smart Platform Rental Ltd, an advisor to Energia MTC in Saudi Arabia, and advises other clients around the world. Tel: +44 7900 916933, or E-mail: jeff@claremont-consulting.com