ICm20 2024: Crane manufacturers returned to growth

05 December 2024

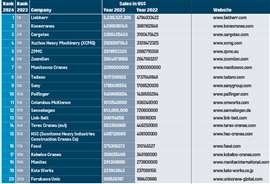

ICm20 table 2024. Image: KHL

ICm20 table 2024. Image: KHL

Most of the change in this year’s ICm20 crane manufacturer ranking is positive and the result of significantly higher crane sales in 2023 over the previous year. This year’s total is up a healthy 5.6 per cent on last year’s table, much more than a complete reversal of the previous year’s 10 % fall and the 4 % drop the year before that.

The combined total sales from crane-related activity for the 20 largest crane manufacturers by revenue (sales in 2023) was US$33,568,385,966. That number is heading back towards the 2021 table’s all-time high of $36,944,945,662. This year’s total is still 9 % down on that but catching up fast. It closely matches the 2020 total.

The 2024 table total is $1,789,593,430 higher than last year. That equates to a lot more cranes delivered. Good news but there are already signs of change that may point towards it being unlikely to be repeated next year. Having said that, 17 of this year’s 20 had higher sales than last year, 10 of those being double digit rises.

Of the three companies showing lower sales, only one was from China, the other manufacturers from there all having turned around their dramatic declines in sales since 2021. XCMG was down 11 % instead of 41 % last year. Zoomlion was up 1.64 %, also a big turnaround from a 48 % decline last year.

From the top

Liebherr retains its top place, maintaining a similar size buffer between it and Konecranes in second place. To do this it managed a strong 12.7 % increase in sales over the previous year. Konecranes’ increase was 17.9 %.

The first change in the table is Cargotec in third, swapping with China’s XCMG, down to fourth. A 12.2 % increase from the Europe-based manufacturer versus an 11 % decline in sales precipitated this change.

Next year this will likely change back, partly because of recovery in China and strengthening exports but also as a result of major changes at Cargotec. It has separated Kalmar as a standalone business and just announced the sale of the MacGregor offshore crane and deck handling division.

The financial reporting to reflect this will change from the first quarter of 2025. Last year Kalmar’s contribution was just over €2 billion and MacGregor’s was €733 million. Cargotec will just be the Hiab loader crane division and the name will be changed to reflect this by dropping Cargotec altogether. Its sales in 2023 were €1.79 billion which will see it move down to somewhere around tenth place in the ICm20.

Back to this year, the next three places, ZPMC, Zoomlion and Manitowoc, 5th, 6th and 7th, respectively, remain unchanged. All three showed increases in sales, the latter by an impressive 10 %. Sennebogen from Bavaria had a really good year, up nearly 27 % and heading towards the one billion milestone.

Also impressive is the recently rapidly expanding Tadano from Japan with its 23.6 % increase over the previous year moving it up one place to eighth. Next year its increase will likely be even bigger, supplemented by sales from recently acquired crane manufacturers Manitex in the USA and parts of fellow Japanese manufacturer IHI’s crane and materials handling business. All this helps it in its long-held ambition to become the world’s largest crane maker.

The next six places, from 10th to 15th, are all unchanged from last year, even though all of them also showed increases in their sales, four of them in double digits. Just outside the top ten Columbus McKinnon, in 11th place, exceeded one billion dollars in revenue for the first time in its history and posted an 8.26 % increase in sales.

The next mover is loader crane manufacturer Fassi from Italy, up one place at 16. The Fassi family sold 70 % of its business to a London, UK-based private equity fund in January 2024, leaving the Fassi family with the remaining 30 %. Giovanni Fassi remains CEO at the company his father started in the 1960s. It has the capacity to make 12,000 cranes a year.

Kobelco in 17th was displaced by Fassi while the remaining three, Manitex, Kato and Furukawa retain the same positions as last year rounding out the top 20. Kobelco sales were virtually flat due to the engine certification issue in Europe hampering sales but conversely sales were boosted by the engine issue in North America being resolved so sales were up there. The forecast is for Kobelco sales to increase by about 7.5 % in 2024.

Notes on the ICm20

Figures used in this ICm20 table for November 2024 are from calendar year 2023 or the 12 month financial year to 31 March 2024. Where possible the year-on-year percentage change figures for sales revenue mentioned in the article are calculated in the reporting currencies of the manufacturers. This is to avoid the effect of exchange rate fluctuation. In some cases the figures are supplied by the manufacturers.

Where stated, the percentage changes are calculated from the figures given in the table which are conversions to US dollars from the various reporting currencies. For the figures in this year’s table the exchange rates from the reporting currencies into US dollars are listed in the table below.

Each year’s table should be taken as a snapshot in that there are occasionally changes in one table made to the previous year’s figure the next year, for example, if new data for the year becomes available after one year’s table was published that data may be substituted in the next table. Attempts are made at appropriate explanation in those instances.

Some companies, often based in Asia, are changing their reporting from an April to March financial year to a January to December calendar year. In those cases three quarters from April to December plus the first one of the following year will be used in the first instance until the first full new calendar year of figures is available.

Exchange rates on 19 November 2024 from xe.com (The ICm20 table does not account for exchange rate fluctuations from year to year)

US$/Euro US$1 = €0.94

US$/Japanese Yen US$1 = JPY154

US$/Chinese Yuan (RMB) US$1 = CNY(RMB) 7.23

US$/Malaysian Ringitt RM (MYR) US$1 = 4.47 MYR