Is Herc’s acquisition of H&E a good deal?

24 February 2025

With Herc announcing perhaps the biggest rental acquisition in history, rental consultant Jeff Eisenberg breaks down the numbers, the risks, and what this mega-deal means for the US rental market.

Image: Herc Rentals

Image: Herc Rentals

United Rentals announced in January its intention to acquire H&E Rentals, the fourth largest rental company in the US, for a value of $4.8 billion. Then last week, in a surprise counterbid, Herc Holdings Inc. offered $5.3 billion. Is it a good deal? What does this mean for Herc Rentals and the rest of the rental industry?

History of M&A in the US rental market

Since the 1990s, the US rental market has been remarkably transformed by consolidation, by way of mergers and acquisitions. United Rentals was born as a consolidator, an acquirer of companies in a fragmented industry.

M&A is in the DNA of United Rentals. Its founder Brad Jacobs had previously participated in the consolidation of the waste disposal industry, growing United Waste Systems to its stock market IPO and subsequent sale to Waste Management Inc. for $2.2 billion.

United Rentals has acquired over 200 rental companies, including more than a handful valued at over $1 billion each.

So, it wasn’t too surprising that United Rentals announced its intention to acquire H&E for $4.8 billion.

More surprising was Herc Rentals out-bidding United by half a billion dollars.

Herc Rentals equipment being delivered.

Herc Rentals equipment being delivered.

Herc, originally part of Hertz Global Holdings (including worldwide car rental activity) until 2016, has been one of the largest rental companies in the world since the 1960s.

Herc grew through a combination of organic growth and acquisitions, with a bias towards organic growth.

Compare this to United which has acquired more than 90 rental companies in a single year.

United Rentals’ 2024 revenue was $15.3 billion, while Herc’s was $3.28 billion. So, a $4 or $5 billion acquisition sounds big for United (in fact the largest in the industry’s history) and for Herc proportionally it’s much larger.

A deeper look at the numbers shows that the acquisition is ambitious for Herc but not overly risky, for several reasons.

United offered to pay $4.8 billion in cash only, while Herc will pay 75% cash and 24% in Herc shares; so just under $4 billion in cash.

Both companies already had adequate bank facilities to handle the amounts committed before the bidding started.

Capital expenditure guidance for Herc was $700 to $900 million for 2025, and H&E has a fleet younger than Herc’s average, so it is interesting to compare this to H&E’s original fleet cost of $2.9 billion.

Synergies for the Herc/H&E acquisition

The combined company will benefit from several synergies. Both United Rentals and Herc gave specific numbers for the savings/efficiencies from the acquisitions.

The detail provided is welcome against a general trend in recent years of rental M&As revealing less information about acquisition pricing, particularly by family-owned companies and private equity investors.

The first synergy is overhead and cost savings. United routinely commits to amounts for larger acquisitions, puts them in investor presentations, and answers questions from analysts. For its H&E proposal United showed $130 million of cost and efficiency savings reachable in two years.

The second synergy is revenue synergy, including cross-selling. H&E is very focussed on aerial platforms, earthmoving and material handling, while both United and Herc have very broad fleets including large speciality rental offerings.

So both would rent more of their specialty equipment to the existing H&E customer base. Think power, pumps, shoring, temporary accommodation, heating and cooling and more. United predicted $120 million per year of revenue synergies for the H&E transaction.

Equipment acquisition cost for the largest rental companies represents a big savings opportunity due to volume purchases.

United Rentals told analysts it could save 5% over the H&E costs. Herc combined with H&E might save somewhat less, but every 1% saving on $10 billion of fleet is still $10 million.

Finally, tax savings for the acquirer can be significant. United predicted this was worth $54 million, a large enough sum to be included in calculations for the valuation.

Herc was more bullish than United on the combined synergies, showing $300 million of incremental EBITDA by the end of year three.

How to value the acquisitions?

The most common valuation method for rental companies is twelve months of EBITDA times a multiple. EBITDA is Earnings Before Interest Tax Depreciation and Amortisation, a type of operating cashflow before depreciation.

This is also called an Enterprise Valuation. The value total includes the company’s debt, so the shareholder(s) would get the Enterprise Value less the debt when the company is acquired.

Enterprise Value is used rather than “profit before tax” to make comparisons between companies easier due to different depreciation periods.

Some rental companies depreciate their rental fleet over five years, some 10, some more, changing when the cost occurs.

Anecdotal information shows negotiations start at 5x to 6x EBITDA in Europe, while the US sees more 6x or 7x. There are many exceptions: it shifts downward for older fleets or lower profitability and growth, and upwards for unique, fast growing and especially speciality rental.

Offer EBITDA multiples compared

In this case, United’s offer for H&E quoted an EBITDA multiple of 6.9x, and for United it’s effectively lower at 5.8x, taking into account “adjusted EBITDA including $130 million of targeted cost synergies and the net present value of tax attributes estimated at approximately $54 million.”

Outside the US, rental company investors are often cynical about quoting the multiple with synergies included, but the stock market analysts accept this where the management team is experienced at integrating rental companies.

Both Herc and United have acquired many rental companies over decades and have this credibility. Analysts are less optimistic for acquisitions by private investors or private equity.

Herc quoted three different EBITDA multiples. 7.4x EBITDA for the acquisition including tax benefits, 6.3x with cost synergies and 5.2x including revenue and cost synergies.

Is this a good deal for Herc?

H&E will be acquired for twice the value of its equipment fleet, and over three times its annual revenue.

The EBITDA multiple is 7x, higher than some acquisitions, but not as high as specialty rental companies in recent transactions.

If private rental companies can be worth 5 to 7 x EBITDA or more, compare this to the EBITDA multiples of the more profitable rental companies themselves quoted on stock markets.

A Herc generator on residential building site in Nantucket, Massachusetts during the summer of 2024. (Photo: IRN)

A Herc generator on residential building site in Nantucket, Massachusetts during the summer of 2024. (Photo: IRN)

According to Finbox, the equity analysis website, United Rentals’ own EBITDA multiple valuation had a median of 11.9x from 2020 to 2024.

Ashtead / Sunbelt averaged over 8x in the last years, and is currently 7.72x. Herc is currently 7.89x and accommodation and portable storage business WillScot is 16.2x EBITDA (all at 14 Feb, 2025).

These rental companies are not all directly comparable, but the observed EBITDA multiple is interesting compared to the headline of 5 to 7x for Herc H&E.

Accretive to earnings

In financial jargon, this acquisition will be “accretive to earnings” in the first year, meaning it will help Herc’s earnings incrementally, even after amortising the goodwill associated with the valuation of H&E.

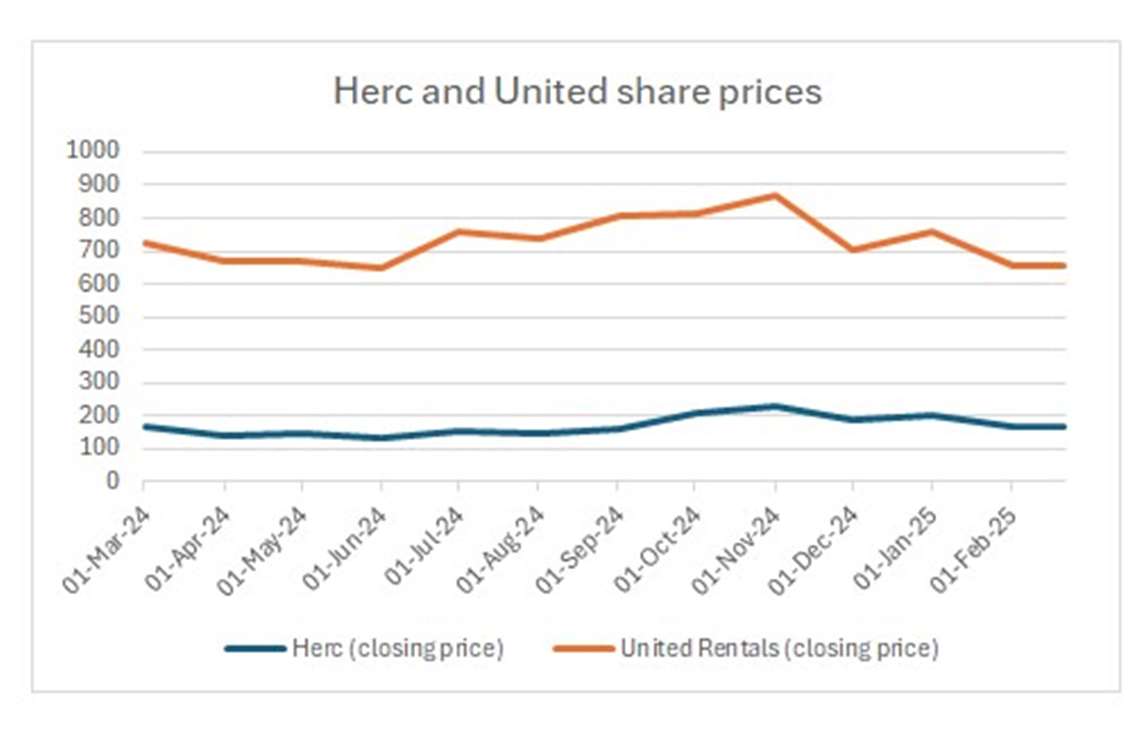

Stock market traded companies receive very quick feedback from their investors as their share price moves daily and even minute by minute.

Both United’s and Herc’s share prices are up since January. Both share prices have seen smaller movements from their various H&E announcements than from general economic news, so I see this as positive feedback from the stock market.

Time will tell if it was a good deal or not. I suspect it is.

One question is when will we see more billion dollar acquisitions or offers by United, Herc and others outside the US? At the end of the day, Herc’s acquisition of H&E is essentially a bet on the US rental market continuing to grow, and grow profitably.

The author: Jeff Eisenberg has been in the rental business since starting at Genie in the 1990s financing rental company expansions. He has advised, started, run, acquired and sold rental companies on multiple continents. Currently he is a non-executive director at UK-based Smart Platform Rental, and advises other clients around the world on M&A and sustainable energy. Tel: +44 7900 916933, email: jeff@claremont-consulting.com