Reflecting on 2024: crane sales defy economic slowdown

06 January 2025

Crane sales continued to rise in 2024, despite a slowing growth in the construction market and falling sales of other types of construction equipment.

Construction activity took off during the pandemic, particularly the housebuilding sector where the stimulus of low interest rates and direct injections of cash from job protection schemes encouraged individuals to move to bigger properties or renovate their homes. More recently, the CHIPS Act has driven a boom in the construction of factories, which in-turn moved the needle upwards on the entire non-residential building segment, while the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), have given a boost to infrastructure construction.

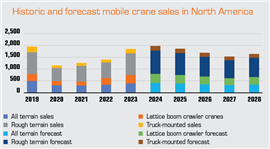

Specialist forecaster Off-Highway Research was expecting about 7 percent growth in crane sales in North America in 2024.

Specialist forecaster Off-Highway Research was expecting about 7 percent growth in crane sales in North America in 2024.

This all shows up in data from the Census Bureau for the value of construction put in place (see chart). The steepness of the climb for residential building during the pandemic and the record highs which each of the three components of construction have reached are all striking.

Remarkable boom

Part of the surge in value was linked to higher costs for everything from materials to labor, but even taking the inflationary effects out of the equation, it was a remarkable boom for the industry. Some 1.7 million housing permits were issued in 2021 and 1.6 were issued in 2022 – levels not seen since the mid-2000s (but which fortunately did not seem to tip over into boom and bust territory).

The interest rate rises of 2022 and 2023 which were needed to curb inflation took some of the heat out of the market, but with 1.45 million permits issued in 2023, it was still a respectable year. The run rate for 2024 to date at the time of writing pointed to about a 3 percent increase in permits for the year – around 1.5 million – which would again be a good volume.

One of the reasons for this is that there is still a lot of ground to make up following the abnormal low in housebuilding which was seen from about 2008 to 2014 in the wake of the sub-prime crisis and global financial crisis. Estimates vary, but the shortfall of housing in the U.S. is still put at 3 to 5 million units. That will be the work of many years to overcome.

As far as the current cycle is concerned, the construction markets look to be topping-out in 2024. The one-off boosts that have been apparent from the various policies of the pandemic era look to have run their course, while residential construction is healthy, but probably as high as it is going to get. There may be a little more upward movement as interest rates come down over the next 12 to 18 months, but this is against the backdrop of a somewhat weak economic outlook in terms of GDP growth.

Election uncertainty

The other factor over the last year has been uncertainty in the run-up to the election. It was clear in 2016 that many buying decisions were put off until after the election, which gave clarity to the country’s policy direction for the next four years. That was clearly the case over the course of 2024 in what was, even by the standards of recent election campaigns, something of an unusual and unpredictable chain of events.

The combination of high interest rates and uncertainty ahead of the results certainly took its toll on the higher volume end of the construction equipment market, with sales of earthmoving, compact and off-road materials handling equipment falling around 10 percent over the course of 2024.

This has to be seen against the context of the sensational years of 2021 to 2023, when three consecutive records were set for annual sales of construction equipment. The fall in 2024 was therefore a return to normal (although still with high sales volumes) after an unsustainable boom during the pandemic.

Sustained growth

In contrast, the market for mobile cranes (all-terrain, rough terrain, truck and crawler cranes) in North America continued to grow in 2024. Specialist forecaster Off-Highway Research was expecting about 7 percent growth in sales for the year.

Mobile crane sales bucked the trend in the wider equipment market for several reasons. First, the high volume construction equipment types such as mini excavators and compact tracked loaders are particularly affected by housebuilding activity, which had something of a reset over 2023 and 2024. There was also some saturation in the market for these machine types following the boom years of the pandemic.

In contrast, crane sales are more closely linked to infrastructure and non-residential building, which continued to rise in 2024.

A second factor is that it took the mobile crane industry a long time to get over the supply chain constraints of the pandemic years. Whereas sales of high volume construction machines soared to a series of record highs in the early 2020s, it was only in 2024 that sales of mobile cranes came back to their pre-Covid levels. It seems likely that 2024 will prove to be the high water mark for crane sales in the current cycle. A modest decline can be expected in 2025 against a backdrop of fairly mediocre economic growth and construction markets that have topped-out.