RentalTracker survey: sector stabalises, but eyes turn to 2025

22 July 2024

How is sentiment among rental companies in Europe holding up? IRN Editor Lewis Tyler reports on the ERA/IRN RentalTracker survey for the second quarter of 2024.

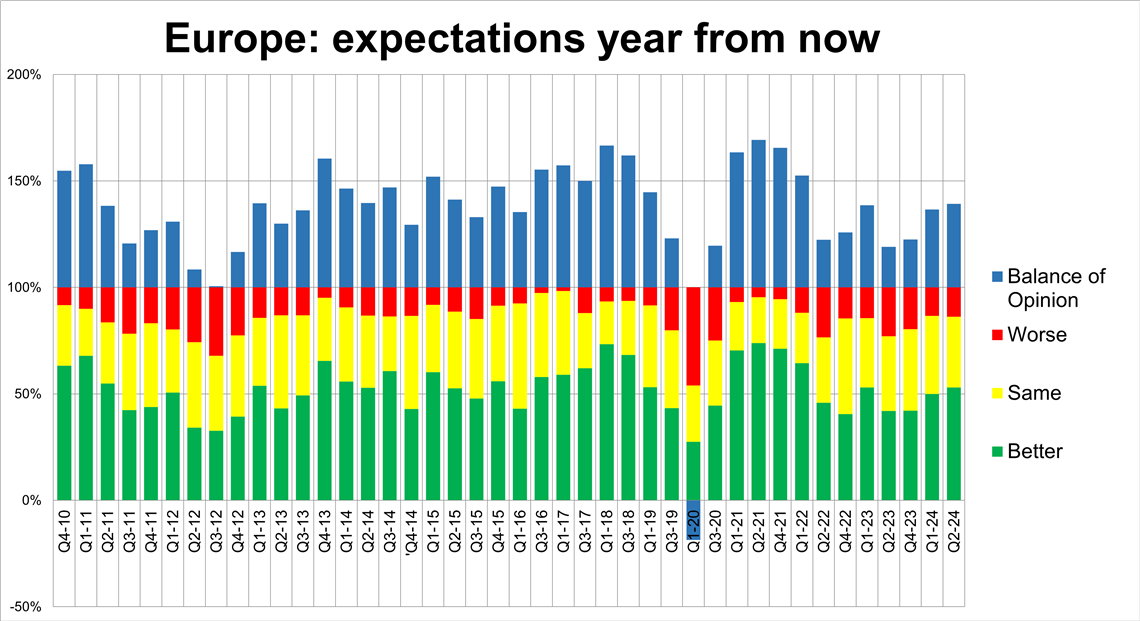

Expectations for a year from now in Europe’s equipment rental industry. (Photo: IRN)

Expectations for a year from now in Europe’s equipment rental industry. (Photo: IRN)

If responses to the ERA/IRN RentalTracker for the first quarter of 2024 exposed some apprehension for the present, the survey for the second quarter will do little to ease those concerns.

The general view of the industry largely remains stable, but with continuing caution on capital investment and mild hopes for a better 2025.

As such, the Q2 2024 ERA/IRN RentalTracker, carried out between mid-June and early July, reveals a continuing shift in sentiment for companies looking ahead just as much as they are focusing on the present.

Looking at responses for forecasts for a year from now, there is a +39 positive balance of opinion (the difference between the proportions with positive and negative views), with just 14% of responses predicting worse conditions next year and 53% predicting an improvement.

That’s similar to the end of Q1 this year and certainly better (mostly) than in 2022 and 2023.

Companies in the Benelux region come out on top in this metric, with 71% of responses expecting to be better off in 12 months’ time.

The Nordics (64%) and multinational companies (58%) also come off well, although sentiment among the latter has dropped off in recent months.

At the other end of the spectrum, companies in France (21%) and Spain (18%) continue to see a deterioration, although in the case of Spain, that is in a context of consistently positive sentiment for some time, so a falling off of expectations for 2025 might be expected.

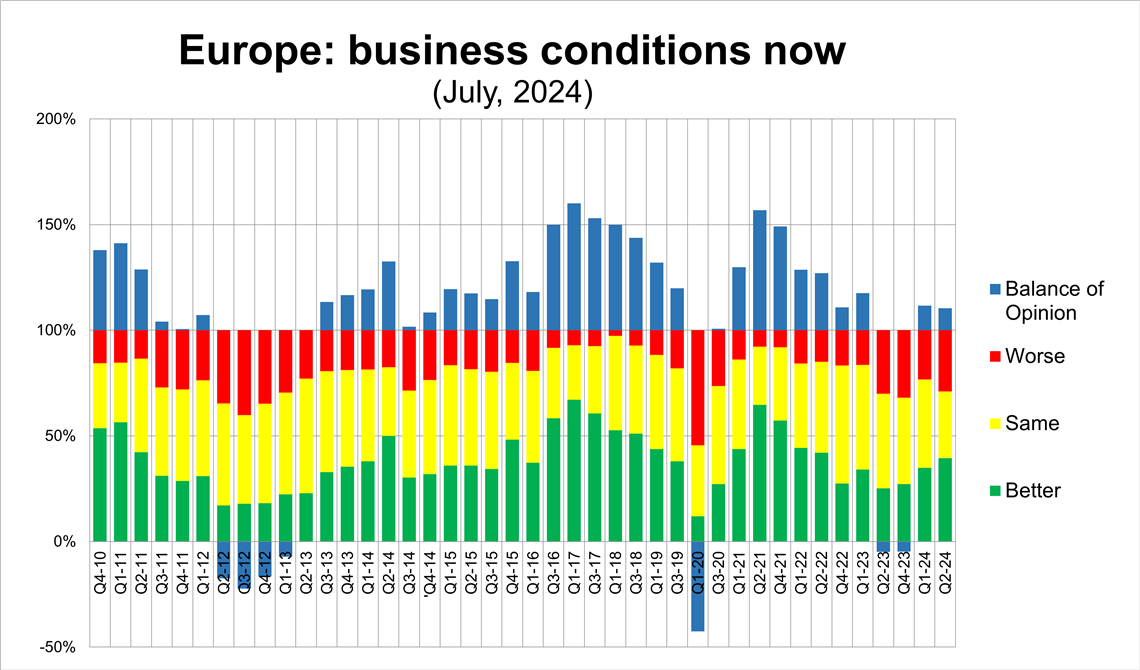

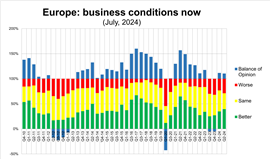

Focusing on the here and now, more specifically current conditions, there is a very slight drop in the balance of opinion from the first quarter of companies reporting better business conditions, although opinion has become more polarised: 40% reported improving conditions while 29% are seeing a worsening environment. The proportion seeing ‘no change’ was 31%, which compares to 42% at the end of the first quarter this year.

It’s worth pointing out that the number of positive responses is the highest for two years.

The survey does hold some positives for current market conditions. Spain has the highest number of ‘improving’ responses at 67%, while data for the Nordics (55%), Multinationals (47%), Benelux (43%) and France (32%) all show improvements on the first quarter.

The survey reveals a very slight drop in the balance of opinion for current conditions from the first quarter. (Photo: IRN)

The survey reveals a very slight drop in the balance of opinion for current conditions from the first quarter. (Photo: IRN)

Companies in Italy (30%) and the UK & Ireland (20%) are least positive on current business conditions

By contrast, Germany is the country that posts the largest decrease in positive sentiment from Q1, shifting from 36% to just 24%.

Year on year growth

The Benelux features among the top in positivity in growth for the second quarter, as it does with current sentiment.

When compared with the same period last year, 50% of responses from companies in the region said conditions have improved, although it should be noted that in our last survey this figure was 76%.

There’s also room for positivity among companies in France and multinational companies. However, the picture is less positive for companies in the Nordics, Germany, Italy and the UK & Ireland.

Our data for Germany shows only 13% companies there reported higher activity in Q2 this year compared to the same period last year..

Looking at expectations for the full year 2024 compared with 2023, although there is a positive balance of opinion of 20%, this is down from 32% at the end of Q1 – clearly sentiment surrounding the current year has dropped.

You have to go back to the second quarter of 2023 to see it as low. In fact, since the first quarter of 2021 – when post-Covid recovery was dominating - that metric has largely stayed above 50%.

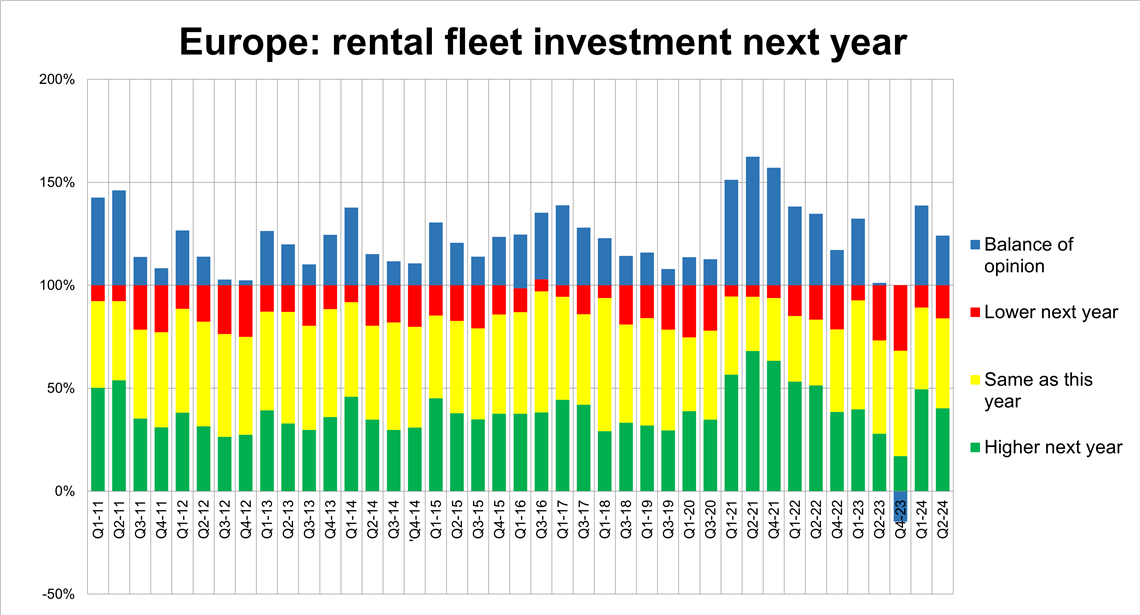

Elsewhere, the balance of opinion on fleet investment for this year is still negative (-2%) – in other words, those expecting to spend more are balanced out by those spending less. Even so, just 30% will spend less in 2024 and 70% will maintain or increase their spending from 2023 levels, which is not a bad result.

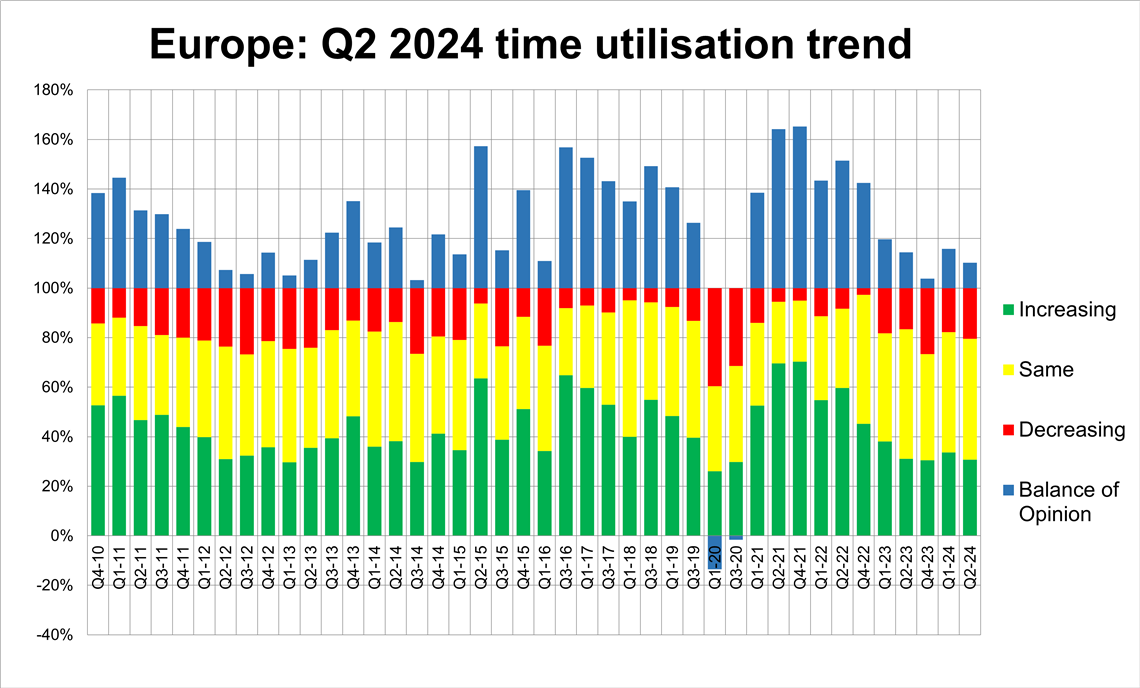

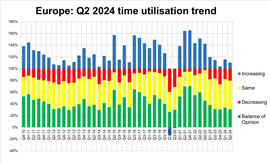

Balance of opinon on utilisation remains stable, albeit with a slight decrease in sentiment. (Photo: IRN)

Balance of opinon on utilisation remains stable, albeit with a slight decrease in sentiment. (Photo: IRN)

Looking at expectations on fleet spending for next year, while sentiment has softened a bit from the Q1, there is still a healthy +24% balance of opinion.

Some 84% of respondents will maintain or increase spending next year and just 16% expect investment to fall.

The survey also reveals a very slight deterioration of utilisation levels on Q1, with a +10% balance of opinion among respondents, down from +16% on Q1 but still an improvement on the 4% seen at the end of 2023.

In the utilisation metric, Italy leads the way with 60% reporting an improvement, although that should be viewed as anecdotal, given the relatively modest number of responses we had from Italy.

There will be little overall change in what companies were reporting on utilisation rates in Q2, although it is notable that companies in Germany and also multinational players were less positive about utilisation trends than in the first quarter.

Employment plans

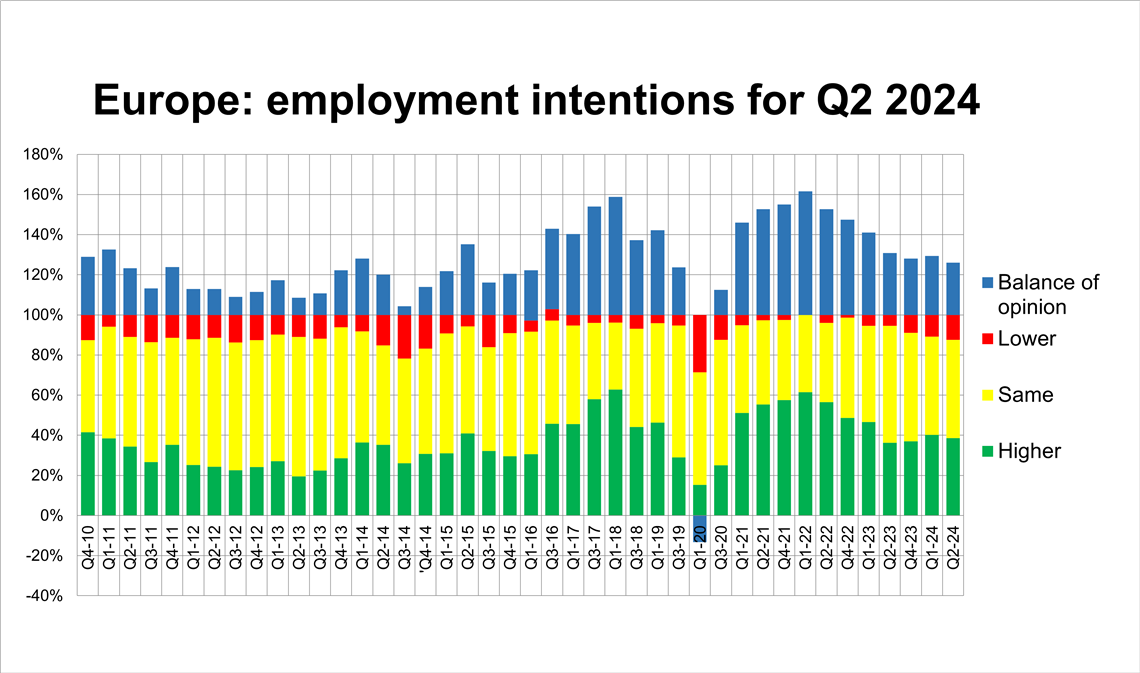

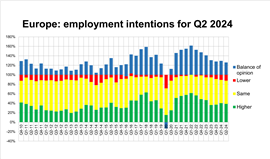

How about employment intentions? It has been well documented that companies in Europe are struggling to fill skilled roles and retain staff, and that is seemingly backed up in the survey for intentions in the third quarter of 2024.

Employment intentions continue to drop, with Spain, the Benelux and multinationals the most likely to recruit more staff. (Photo: IRN)

Employment intentions continue to drop, with Spain, the Benelux and multinationals the most likely to recruit more staff. (Photo: IRN)

The balance of opinion here – the difference between the proportions who will increase or decrease recruitment - is +26%, down slightly from 29% in Q1.

Given the relatively modest business environment overall, there are still a lot of companies looking to recruit.

Companies in Spain, the Benelux and multinationals are the most likely to recruit more staff; those in France, the Nordics, Italy, Germany and the UK the least likely (but all still with a positive balance of opinion).

So, in the context of previous survey findings, the message from responses seems to be one of ‘wait it out’ and can be perhaps seen as a continuation of our previous survey, with some mixed messages (no great expectations for 2024, but cautious optimism for 2025).

It will be interesting to see if the positive sentiment on the future holds out into the final quarter of 2024 and first of 2025.

Notes:

- The full report, with more data, will be published in the July-August issue of International Rental News.

- The survey was conducted in the final half of of June 2024 and the first week of July 2024, with 123 companies in Europe taking part. IRN would like to thank ERA and national rental associations in Europe for their help in distributing the survey.