The five top-performing sectors in construction

23 June 2023

Image: sorchai via AdobeStock - stock.adobe.com

Image: sorchai via AdobeStock - stock.adobe.com

A wide-ranging new report into the global construction market has revealed the five top-performing sectors of the industry.

Professional services firm Turner & Townsend’s latest International Market Survey offers an outlook on the global economy as well as the global construction industry, bringing together data from 89 different cities.

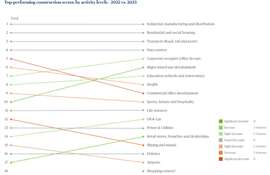

As part of that, it tracks activity levels in 18 different sectors within the construction market.

The five top-performing sectors were:

1) Industrial, manufacturing and distribution

Turner & Townsend said that continued growth in e-commerce assured industrial, manufacturing and distribution took the top spot.

Growth in that sector has also been driven by the fall-out from the Covid-19 pandemic and geopolitical tensions, which has highlighted the need for countries to restructure and build resilience into their supply chain by re-shoring production or moving it closer.

2) Residential and social housing

Meanwhile, demographic changes and a greater emphasis on public housing investment to reduce home shortages put residential and social housing in second place, in spite of rising interest rates.

3) Transport (road, rail and ports)

There were large pipelines of transport infrastructure projects to be delivered across many markets, according to Turner & Townsend, with infrastructure spending remaining robust, helping to keep markets active while others slow.

4) Data centres

There was strong continued strong investment in data centres and Turner & Townsend predicted that this investment would continue over the remainder of the decade.

5) Corporate occupier (office fit-out)

Commercial office development fell from fifth spot last year to ninth place this year. While ongoing work-from-home arrangements dragged on demand, sustainability became a key focus in many markets, and costs remained at a premium, there was less appetite for new office buildings. But this same trend has driven more growth in the office fit-out sector, which has moved up from seventh place last year to fifth this year.

Source: Turner & Townsend International construction market survey 2023

Source: Turner & Townsend International construction market survey 2023

Further down the list, mixed-use developments, oil and gas projects and retail stores all saw an increase in construction activity.

Meanwhile several categories fell including: health; commercial office development; mining and metals; and airports all saw a decline in activity.

Reflecting the rise in e-commerce and the effects of the Covid-19 pandemic, shopping centre construction activity sat at the bottom of the list.

‘Heat coming out of advanced economies’

Turner & Townsend’s survey also revealed that the “heat is coming out” of many markets in advanced economies, driven by challenging market conditions and tougher financial conditions.

But it also pointed to growth potential in emerging and developing economies like Africa, Asia, and the Middle East, all of which are expected to see more vibrant activity.

Turner & Townsend found that overall construction activity is softening.

Just 23 of 89 markets in its survey reported tendering activity as either “hot” or “overheating”, which was a reduction of nearly a third compared to last year.

Only two markets were ranked as “overheating” – Ottowa in Canada and Riyadh in Saudi Arabia – as a result of strong pipelines of work and robust activity levels.

Turner & Townsend said that markets where tendering conditions are cold or lukewarm experience high competition between contractors for work, resulting in greater commercial tension.

Hot or overheating tendering conditions indicate health project pipelines, meaning less competition for work and higher prices.

US dominates most expensive places to build

The report has also measured the cost of construction in different markets. The US dominates, with six US cities in the top 10.

New York is the most expensive place to build with an average cost of $5,451 per sq m according to the survey, followed by San Francisco at $5,200 per sq m.

Turner & Townsend said the figures have been fuelled by a strong US dollar and the impact of a series of policy interventions by the US government designed to stimulate growth in advanced manufacturing and green technology.

Neil Bullen, managing director, global real estate, at Turner & Townsend said: “The global real estate market and the construction industry which supports it is being weighed down by inflationary headwinds and worldwide skills shortages. Even as interest rate rises start to bring inflation down, we are seeing the knock-on impact of higher borrowing costs for private investment in construction.

“While established markets are highly pressured, newer emerging locations are increasingly appealing for investors – whether that is secondary cities within the US, or growing economies in India and south east Asia.

“In either case, keeping close to supply chains is critical to understand capacity, benchmark costs and de-risk investment. Real estate clients need to look holistically at the construction ecosystem to identify areas of innovation in build processes and ongoing operations that improve performance.”

| Region | Ranking (/89 markets) | Cost per sqm (US$) | 2022 inflation (%) | 2023 inflation (%) | Wages / hour (US$) | |

| New York City | North America | 1 | 5,451 | 11 | 6 | 126.8 |

| San Francisco | North America | 2 | 5,200 | 6 | 3.5 | 134.8 |

| Geneva | Europe | 3 | 4,662 | 7.2 | 6.5 | 120.3 |

| Zurich | Europe | 4 | 4,653 | 8.6 | 6.5 | 120 |

| Tokyo | Asia | 5 | 4,567 | 9 | 7.5 | 28.8 |

| Osaka | Asia | 6 | 4,497 | 9 | 7.5 | 26.1 |

| Boston | North America | 7 | 4,453 | 7 | 5 | 118.2 |

| Los Angeles | North America | 8 | 4,414 | 7.5 | 4 | 93.5 |

| Chicago | North America | 9 | 4,404 | 7 | 5 | 79.2 |

| Seattle | North America | 10 | 4,400 | 9 | 5 | 97.5 |

Source: Turner & Townsend International Market Survey 2023