Trendlines: Will it be different this time for South America?

04 December 2023

Construction equipment sales in South America may be set to buck historical downward trend

South America is the latest region to be added to Off-Highway Research’s global coverage. Our figures show sales in the five biggest markets of Argentina, Brazil, Chile, Colombia and Peru totaled more than 65,500 machines in 2022, with a value of more than $8.5 billion.

That was a record high. But what goes up must come down, so we all know what happens next. Or do we?

It is true that the South American market has a habit of being either all the way up or all the way down. The current upswing has come after a few grim years in the middle of the 2010s when sales were low and growth was anemic.

Lift-off came in 2021, as it did for most markets around the world, as stimulus measures triggered enormous demand for construction machines. In South America’s case, the market almost doubled in a year, and it is perhaps natural to expect a sudden downturn after such a sudden spike.

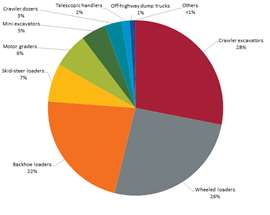

2023 sales in South America, broken down by equipment type. (Graph: Off-Highway Research)

2023 sales in South America, broken down by equipment type. (Graph: Off-Highway Research)

After the record sales of 2022, we certainly expect demand to be lower this year and the downturn could be in the 15% to 20% range. But this will bring the market to a more natural level after the abnormal high of 2022. The forecast thereafter is for sales to stabilize at a good level. To understand why we think markets will buck the historical trend, it is important to delve into the details.

Brazilian market

The first and biggest factor is Brazil. At the moment, the country accounts for some 70% of South American equipment sales. What happens in Brazil swings the entire continent’s market.

This was true in the difficult years in the second half of the 2010s, when the fallout from the Petrobras scandal put the state and its relationship with the construction sector under enormous and perfectly justified scrutiny. As necessary as this was, it paralyzed the industry for years.

But while this was going on, many of the smaller markets performed well. There was steady growth in Chile, Colombia and Peru, while Argentina was good at times – and awful at others. Unfortunately, Argentina will be awful again this year thanks to its triple-digit inflation, but this is the only real negative in our outlook.

Looking at our forecast, the obvious point is that because we expect the South American market as a whole to remain strong, we expect the Brazilian market to remain strong. High commodity prices have fueled demand for equipment in extraction and agriculture alike. Although that inflationary spike is now diminishing, we expect demand for commodities to stay strong enough to keep driving investment in capital equipment in these areas.

The second positive we see in Brazil is a renewed focus on infrastructure investment through PAC (Growth Acceleration Program), a key policy initiative by President Lula da Silva in his first term of office from 2003-2010, and one he was swift to resurrect on taking office at the start of this year.

Another reason we believe the Brazilian market will be strong for a while is that this is badly needed. After a long period of reduced sales in the late 2010s, the country’s fleet of equipment is old and badly in need of replacement. The current period of prosperity and better certainty for equipment buyers should give them the confidence to renew their worn-out machines.

Finally, we see greater maturity in the South American market. A bigger rental industry has emerged from the hard times of the 2010s and this now accounts for more than 25% of sales. Equipment choices also show some of the hallmarks of a maturing industry, with growth in compact excavators, small wheeled loaders and telehandlers – machines that typically replace manual labor or less sophisticated solutions.

Risks and uncertainties

Any forecast has its risks and uncertainties. Inflation is always a concern in Latin America. And although this has been a problem in the last one to two years (as it has been everywhere in the world), it has only caused cataclysmic problems in Argentina. The rest of the region’s big economies are pulling through.

The second concern is political stability. The market was brought to its knees in the 2010s by the Petrobras scandal and it is not beyond the realms of possibility another crisis could come out of left field to scupper growth.

But today, knowing what we know and looking at the market situation and economic prospects, we believe that are more reasons to be positive than negative.